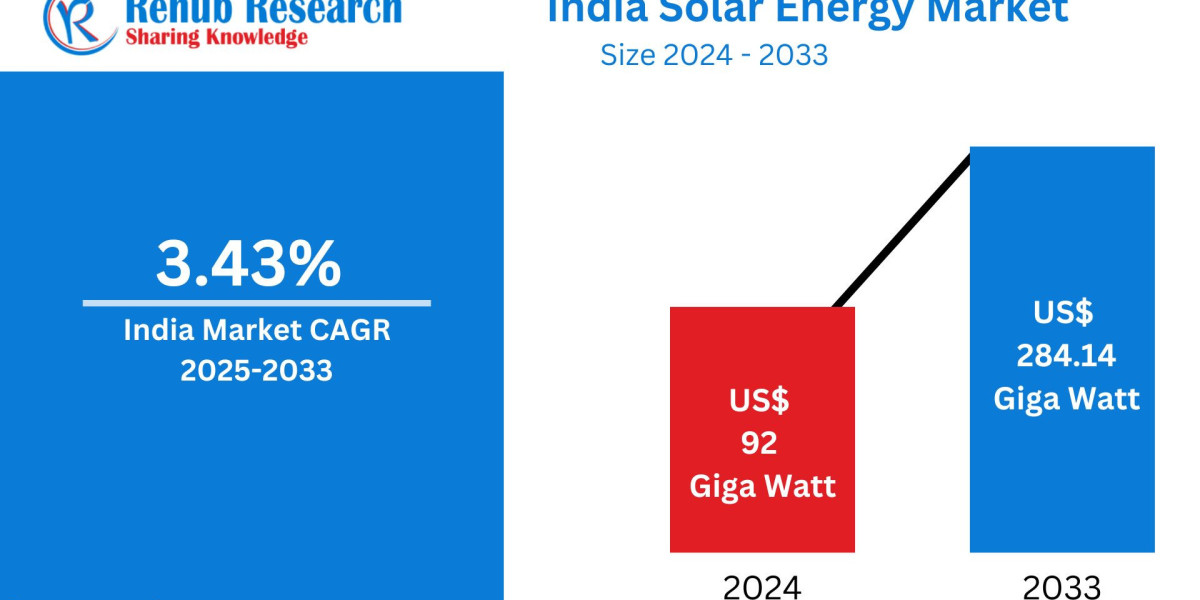

? India Solar Energy Market Analysis Size

The India Solar Energy Market is poised for significant growth, projected to surge from 92 Giga Watt in 2024 to 284.14 Giga Watt by 2033, reflecting a CAGR of 13.35% during the forecast period. The acceleration is driven by robust government initiatives, falling solar technology costs, soaring electricity demand, a growing preference for clean energy, and a broader global push toward net-zero carbon emissions.

Want pricing & detailed TOC? Enter your email:https://www.renub.com/request-sample-page.php?gturl=india-solar-energy-market-p.php

This in-depth report provides detailed insights and forecasts across Technology (Solar Photovoltaic, Concentrated Solar Power), Application (Residential, Commercial, Industrial), Regions (East, West, North, South India), and includes comprehensive Company Analysis from 2025 to 2033.

? Table of Contents

- Executive Summary

- Market Overview

- Market Size and Forecast (2025–2033)

- Growth Drivers

- Market Challenges

- Regional Insights

- North India

- South India

- West India

- East India

- Market Segmentation

- By Technology

- By Application

- By Region

- Competitive Landscape

- Company Profiles

- Strategic Recommendations

- Conclusion

? India Solar Energy Market Overview

India’s solar energy sector is one of the most dynamic and rapidly evolving renewable energy markets globally. Its strategic geographic position ensures high solar insolation levels throughout the year, providing immense potential for both rooftop and utility-scale solar installations.

Significant strides have been made under national programs like the Jawaharlal Nehru National Solar Mission (JNNSM), along with supportive state policies, capital subsidies, and net metering regulations. The government's PLI (Production Linked Incentive) scheme and solar park development initiatives have attracted foreign and domestic investment, giving rise to a robust solar manufacturing ecosystem and utility-scale deployment.

India’s installed solar PV capacity has surged from 49.3 GW in 2021 to 62.8 GW in 2022 — a 31% YoY increase, driven primarily by large-scale solar PV installations. This growth trajectory is expected to continue, supported by expanding energy access needs, particularly in rural and semi-urban areas.

? Key Growth Drivers

✅ 1. Government Initiatives and Policy Support

India’s solar surge has been significantly propelled by favorable government policies:

- National Solar Mission targeting 280 GW of solar by 2030.

- PLI scheme for boosting domestic module and cell manufacturing.

- Net metering regulations and capital subsidies for rooftop solar.

- Solar Parks Scheme enabling plug-and-play infrastructure.

- State-specific incentives fostering utility and rooftop installations.

These frameworks offer fiscal incentives, simplify land acquisition, reduce regulatory barriers, and create investor confidence — laying the foundation for long-term sector expansion.

✅ 2. Soaring Electricity Demand

India’s growing industrial base, urban population, and technological penetration are escalating electricity demand. To sustainably meet this rise:

- Solar power offers a cost-competitive and environmentally safe alternative.

- Industrial and commercial users are adopting solar to reduce power bills and meet ESG goals.

- Government targets for becoming a $5 trillion economy by 2030 necessitate grid upgrades and decentralized power.

✅ 3. Grid Modernization & Energy Storage Systems

Modernization efforts are crucial for solar-grid integration:

- Smart grids, automated load dispatch, and real-time monitoring enhance stability.

- Battery Energy Storage Systems (BESS) help offset solar’s intermittency.

- Hybrid projects (solar + wind + storage) are gaining traction in grid-constrained areas.

This enables 24/7 clean energy access, even in off-peak sunlight hours.

⚠️ Challenges in the Indian Solar Market

❌ 1. Land Acquisition Issues

- Utility-scale projects require large tracts of land, often in rural or disputed ownership zones.

- Delays in approvals, high land prices, and local opposition slow down project execution.

- Fragmented policies and legal ambiguity around land titles further complicate development.

❌ 2. Financing and Investment Hurdles

- High upfront capital costs and lack of long-term financing deter SME solar developers.

- Credit risks of power off-takers (DISCOMs) and payment delays affect investor confidence.

- Interest rates and limited access to green financing pose additional constraints.

- Innovative financial instruments and government-backed credit guarantees are crucial for inclusive growth.

? Regional Market Insights

? North India Solar Energy Market

- Led by Rajasthan with massive solar parks like Bhadla Solar Park (2,245 MW).

- Punjab and Uttar Pradesh see rising rooftop and distributed solar demand.

- PM Surya Ghar Muft Bijli Yojana is pushing residential rooftop adoption.

- High irradiance levels and supportive policy make this region a solar hotspot.

? South India Solar Energy Market

- Tamil Nadu, Karnataka, and Andhra Pradesh are leaders in installed capacity.

- Tamil Nadu’s solar capacity reached 9,414 MW in 2024, the highest in India.

- Karnataka accounts for nearly 29% of open access solar capacity.

- Tata Power Renewable Energy’s $5.63 billion investment in Andhra underlines the region’s importance.

? West India Solar Energy Market

- Rajasthan, Gujarat, and Maharashtra dominate with over 70% of 2024's utility installations.

- Gujarat’s Khavda Renewable Energy Park aims to be the world’s largest (445 sq. km).

- Maharashtra’s 6,600 MW deal with Adani Green Energy expands solar footprints.

- World-leading infrastructure and solar irradiation levels drive growth.

? Market Segmentation

? By Technology

- Solar Photovoltaic (PV) – Dominant technology, cost-effective and scalable.

- Concentrated Solar Power (CSP) – Niche, suited for high DNI zones and hybrid use.

? By Application

- Residential – Rooftop solar, net metering policies, subsidies driving adoption.

- Commercial – Commercial buildings, malls, and institutions reducing costs via solar.

- Industrial – High power demand industries integrating solar for energy independence and ESG goals.

? By Region

- North India

- South India

- West India

- East India

? Key Companies & Competitive Landscape

Major Players (Covered from 4 Viewpoints: Overview, Key Persons, Business Strategy, Financial Insight):

- Adani Solar

- Tata Power Solar Systems Ltd.

- ReNew Power Pvt. Ltd.

- Emmvee Solar

- Mahindra Susten Pvt. Ltd.

- Vikram Solar Limited

- Sterling and Wilson Pvt. Ltd.

- NTPC Ltd.

- Azure Power Global Ltd.

These players are leveraging scale, backward integration, innovation in solar cells/modules, and hybrid project execution to dominate the competitive landscape.

? Conclusion & Strategic Outlook

India’s solar energy sector is not only central to meeting its domestic energy needs but also crucial for achieving its global climate commitments. The nation’s vast untapped solar potential, backed by regulatory support, rising demand, and technological innovation, makes it one of the most attractive solar investment destinations globally.

To unlock full potential:

- Streamline land acquisition policies.

- Strengthen DISCOM finances.

- Scale energy storage deployment.

- Enable inclusive financing and green bond markets.

With the right infrastructure and institutional support, India could become a global solar powerhouse, transforming its energy ecosystem and leading the charge toward a low-carbon future

New Publish Blogs:

Top Hydroponics Companies Shaping the Future of Indoor Farming

Top Virtual Reality Companies Transforming the Future of Immersive Technology

Top Candle Companies Leading the Global Market in 2025

About Renub Research

Renub Research is a leading market research and consulting company offering management consulting and in-depth industry analysis across various sectors. With a global perspective and a local understanding, Renub Research delivers insights that matter.

About the Company:

Renub Research is a Market Research and Consulting Company. We have more than 15 years of experience especially in international Business-to-Business Researches, Surveys and Consulting. We provide a wide range of business research solutions that helps companies in making better business decisions. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our wide clientele comprises major players in Healthcare, Travel and Tourism, Food Beverages, Power Energy, Information Technology, Telecom Internet, Chemical, Logistics Automotive, Consumer Goods Retail, Building, and Construction, Agriculture. Our core team is comprised of experienced people holding graduate, postgraduate, and Ph.D. degrees in Finance, Marketing, Human Resource, Bio-Technology, Medicine, Information Technology, Environmental Scienc