Executive Summary Insurance and Managed Care Market :

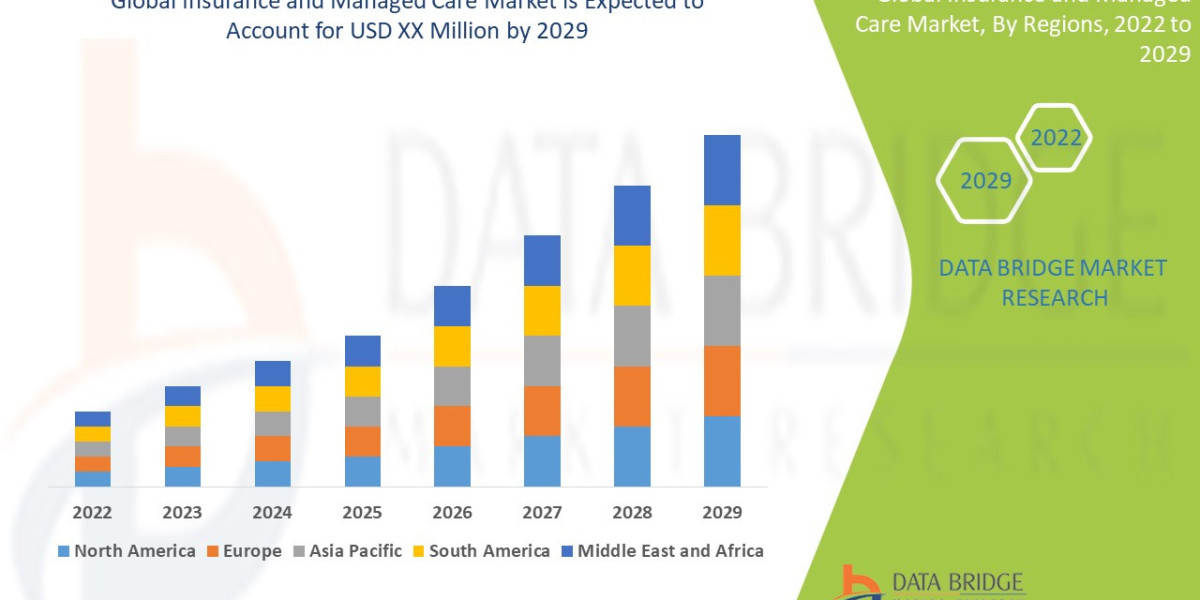

Data Bridge Market Research analyses that the insurance and managed care market which is expected to reach at a healthy CAGR of during the forecast period 2022 to 2029.

Insurance and Managed Care Market report puts forth an absolute overview of the market that contains various aspects of market analysis, product definition, market segmentation, key developments, and the existing vendor landscape. This research study helps the customer comprehend various drivers and restraints impacting the market during the forecast period. The Insurance and Managed Care Market report demonstrates supportive data related to the overriding players in the market, for instance, product offerings, revenue, segmentation, and business synopsis. As today’s businesses seek to go for the market research analysis before taking any verdict about the products, choosing such market research report is necessary for the businesses.

Analysis and discussion of significant industry trends, market size, and market share are estimated in the Insurance and Managed Care Market report. The report employs an excellent research methodology which focuses on market share analysis and key trend analysis. The market research report plays a key role in developing the strategies for sales, advertising, marketing, and promotion. This market research report puts on view comprehensive study on production capacity, consumption, import and export for all the major regions across the globe. Key insights that can be mentioned about the Insurance and Managed Care Market report are complete and distinct analysis of the market drivers and restraints, major market players involved in this industry, detailed analysis of the market segmentation and competitive analysis of the key players involved.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Insurance and Managed Care Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-insurance-and-managed-care-market

Insurance and Managed Care Market Overview

**Segments**

- By Insurance Type: Life Insurance, Health Insurance, Property & Casualty Insurance, Others

- By Service Provider: Public Insurance Providers, Private Insurance Providers

- By Managed Care Service: Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Point of Service (POS) Plans, Others

- By Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

The global insurance and managed care market is segmented based on various factors that play a crucial role in the industry's growth and development. One of the key segments is by insurance type, which includes life insurance, health insurance, property & casualty insurance, and others. Life insurance remains a fundamental segment due to the growing awareness of financial security among individuals worldwide. Health insurance is also a significant segment, driven by the increasing healthcare costs and a focus on preventive care. Property & casualty insurance is essential for businesses and individuals to protect against potential liabilities. Another crucial segmentation criterion is by service provider, distinguishing between public and private insurance providers. Public insurance providers are often government-owned entities that offer coverage to a broader population, while private insurance providers operate for profit and cater to specific market segments. Moreover, the market is segmented by managed care service, including health maintenance organizations (HMOs), preferred provider organizations (PPOs), point of service (POS) plans, and others. These managed care services play a vital role in controlling costs and improving the quality of care for patients. Geographically, the market is divided into regions such as North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each presenting unique opportunities and challenges for insurance and managed care providers.

**Market Players**

- UnitedHealth Group

- Anthem, Inc.

- Aetna, Inc.

- Cigna Corporation

- Allianz Group

- AXA

- Ping An Insurance Group

- CVS Health

- Humana Inc.

- Kaiser Foundation Health Plan, Inc.

The global insurance and managed care market is highly competitive and dominated by several key players that have a significant market share and influence on industry trends. UnitedHealth Group is one of the largest healthcare and insurance companies globally, offering a wide range of services to individuals and businesses. Anthem, Inc. and Aetna, Inc. are also prominent players in the market, providing health insurance solutions to millions of customers. Cigna Corporation and Allianz Group are known for their diversified insurance offerings and global presence. AXA and Ping An Insurance Group are major players in the international insurance market, providing various insurance products and financial services. CVS Health and Humana Inc. are leading managed care companies in the U.S., focusing on value-based care and innovative healthcare solutions. Kaiser Foundation Health Plan, Inc. is a non-profit organization that operates healthcare plans and hospitals, serving millions of members in the U.S. These market players drive competition, innovation, and growth in the global insurance and managed care market. For more insights, visit The global insurance and managed care market is experiencing significant transformation driven by technological advancements, changing consumer preferences, and regulatory reforms. One emerging trend in the market is the increasing focus on personalized insurance solutions tailored to individual needs and risk profiles. Insurers are leveraging data analytics and artificial intelligence to develop innovative products and pricing strategies that resonate with customers. Additionally, there is a growing emphasis on digitalization and online distribution channels to enhance customer experience and streamline operations. Insurtech startups are disrupting the traditional insurance landscape by offering tech-driven solutions for policy management, claims processing, and customer engagement. This trend is reshaping the competitive dynamics of the market as incumbents and new entrants compete to capture market share and drive innovation.

Another key development in the insurance and managed care market is the emphasis on value-based care and population health management. With rising healthcare costs and an aging population, payers and providers are exploring collaborative models to improve outcomes and reduce expenditures. Managed care organizations are investing in care coordination, chronic disease management, and wellness programs to enhance patient well-being and lower overall healthcare costs. Value-based payment models, such as capitation and bundled payments, are gaining traction as alternatives to fee-for-service reimbursement, incentivizing providers to deliver high-quality, cost-effective care. This shift towards value-based care is reshaping the traditional fee-for-service model and driving partnerships between insurers, providers, and other stakeholders to deliver integrated, patient-centered care.

Furthermore, the global insurance and managed care market is witnessing increased consolidation and M&A activity as companies seek to achieve economies of scale, expand their geographic footprint, and diversify their product portfolios. Mergers between insurers, managed care organizations, and healthcare providers are becoming more common as organizations look to strengthen their competitive positions and enhance their capabilities. These strategic alliances enable companies to leverage complementary strengths, improve efficiencies, and capitalize on emerging opportunities in the evolving healthcare landscape. Additionally, industry convergence is blurring the lines between traditional insurance and healthcare services, leading to the emergence of integrated delivery models that offer comprehensive solutions across the care continuum.

In conclusion, the global insurance and managed care market is undergoing a period of rapid change and transformation, driven by technological innovation, regulatory reforms, and shifting consumer expectations. Insurers and managed care organizations are adapting to these dynamics by embracing digitalization, focusing on value-based care, and pursuing strategic partnerships to drive growth and differentiation. As the market continues to evolve, companies that can effectively navigate these trends and capitalize on emerging opportunities will be well-positioned to succeed in an increasingly competitive and dynamic industry landscape.The global insurance and managed care market is undergoing a profound transformation driven by various factors that are reshaping the industry landscape. One key trend is the increasing focus on personalized insurance solutions tailored to individual needs and risk profiles. Insurers are leveraging advanced technologies such as data analytics and artificial intelligence to develop innovative products and pricing strategies that meet the evolving demands of customers. This shift towards personalized offerings not only enhances customer satisfaction but also enables companies to create competitive differentiation in a crowded market. Additionally, the emphasis on digitalization and online distribution channels is gaining momentum, as companies strive to enhance customer experience, optimize operational efficiency, and reach wider audiences. The rise of insurtech startups further accelerates the digitization of insurance processes, offering disruptive solutions that challenge traditional business models and encourage incumbents to innovate to stay relevant.

Another significant trend in the global insurance and managed care market is the growing importance of value-based care and population health management. With escalating healthcare costs and changing care delivery models, payers and providers are increasingly focusing on collaborative approaches to improve patient outcomes and control expenses. Managed care organizations are investing in initiatives such as care coordination, chronic disease management, and preventive care programs to promote holistic patient well-being and reduce healthcare expenditures. This shift towards value-based care models is reshaping reimbursement structures and incentivizing providers to deliver high-quality, cost-effective care. The adoption of value-based payment models signals a broader industry transition towards a more patient-centric and outcomes-driven approach to healthcare delivery.

Furthermore, consolidation and M&A activities are reshaping the competitive landscape of the global insurance and managed care market. Companies are pursuing strategic partnerships and acquisitions to achieve economies of scale, expand market presence, and diversify product portfolios. Mergers between insurers, managed care organizations, and healthcare providers are prevalent as organizations seek to strengthen their competitive positions and capitalize on emerging opportunities in the evolving healthcare ecosystem. These collaborative efforts enable companies to leverage synergies, enhance operational efficiencies, and offer more integrated solutions that span the entire care continuum. The convergence of insurance and healthcare services is blurring traditional industry boundaries, giving rise to integrated delivery models that provide comprehensive and seamless experiences for consumers.

In conclusion, the global insurance and managed care market is witnessing dynamic changes driven by technological innovation, regulatory shifts, and evolving consumer expectations. Companies operating in this sector need to adapt to these trends by embracing digital transformation, prioritizing value-based care initiatives, and exploring strategic partnerships to drive growth and innovation. Successful navigation of these market dynamics will be essential for companies looking to thrive in an increasingly competitive and complex industry environment.

The Insurance and Managed Care Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-insurance-and-managed-care-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Answers That the Report Acknowledges:

- Insurance and Managed Care Market size and growth rate during forecast period

- Key factors driving the Insurance and Managed Care Market

- Key market trends cracking up the growth of the Insurance and Managed Care Market.

- Challenges to Insurance and Managed Care Market growth

- Key vendors of Insurance and Managed Care Market

- Opportunities and threats faces by the existing vendors in Global Insurance and Managed Care Market

- Trending factors influencing the market in the geographical regions

- Strategic initiatives focusing the leading vendors

- PEST analysis of the Insurance and Managed Care Market in the five major regions

Browse More Reports:

Global Mycophenolate Market

Global Building Analytics Market

Europe Digital Signage Software Market

Asia-Pacific Inorganic Scintillators Market

North America MEMS and Sensors Market

North America Medical Carts Market

North America Cardiac Rhythm Management Market

Global Metagonimiasis Treatment Market

Global Respiratory Disposables Market

Global Poultry Packaging Market

Global Waffles Market

Global Cancer Registry Software Market

Global Peripheral Neuritis Treatment Market

Middle East and Africa Epoxy Curing Agents Market

Asia-Pacific Medical Instruments Disinfection Market

Global Heavy Metal Testing for Dairy Products Market

Global Electronic Chemicals and Materials Market

Global HELLP Syndrome Market

Global Needles Market

Asia-Pacific Chronic Disease Management Market

Global Alternative Sweeteners Market

India Pharmaceutical Glass Packaging Market

Global Tricuspid Valve Repair Market

Middle East and Africa Lipid POCT Market

Global Foundry Coke Market

Global Pantothenate Kinase associated Neurodegeneration (PKAN) Market

Global Drug Addiction Treatment Market

Global Barge Transportation Market

Asia-Pacific Immunoassay-Gamma Counters Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com